AI in Upstream Oil & Gas: Strategic Guide

for Drilling Applications

In the oil and gas (O&G) industry, “upstream” refers to activities involved in finding and extracting underground crude oil and gas. The process includes four major phases: exploration, drilling, completions, and production. These operations are asset-heavy, technically demanding, and data-intensive. Understanding the structure and economics of upstream is essential for identifying where and how digital technologies can generate measurable value.

This guide is dedicated to the drilling phase.

Drilling is a process that requires large capital investments and brings with it operational and Health, Safety, and Environment (HSE) risks. Each well drilling process involves mobilizing rigs, executing complex plans for wells, and making real-time decisions under rigid safety and efficiency constraints.

Drilling typically accounts for around 20-40% of upstream capital expenditures. Any enhancements in time expenditure, rate of penetration, and equipment reliability translates directly into cost savings.

Drilling generates high-frequency, multivariate data from surface sensors, mud logs, and daily reports. These data can be used for machine learning and potential anomaly detection.

Unlike longer-cycle phases like exploration or reservoir modeling, the drilling process can take anywhere from a few days up to a month, and it provides immediate operational feedback (online data and decisions), making it suitable for piloting, measuring, and scaling AI applications. Faster drilling means a well will be in production much sooner.

There are several promising entry points into oil and gas where AI capabilities can be applied. Beyond drilling, operators are actively investing in AI for predictive maintenance of critical equipment, production optimization, completions, reservoir management, emissions monitoring and reduction, and supply chain optimization for complex logistics and field operations. These areas present technical and commercial opportunities to expand the company's footprint in the O&G sector by leveraging the same disciplined, operator-first, pilot-led approach used in drilling.

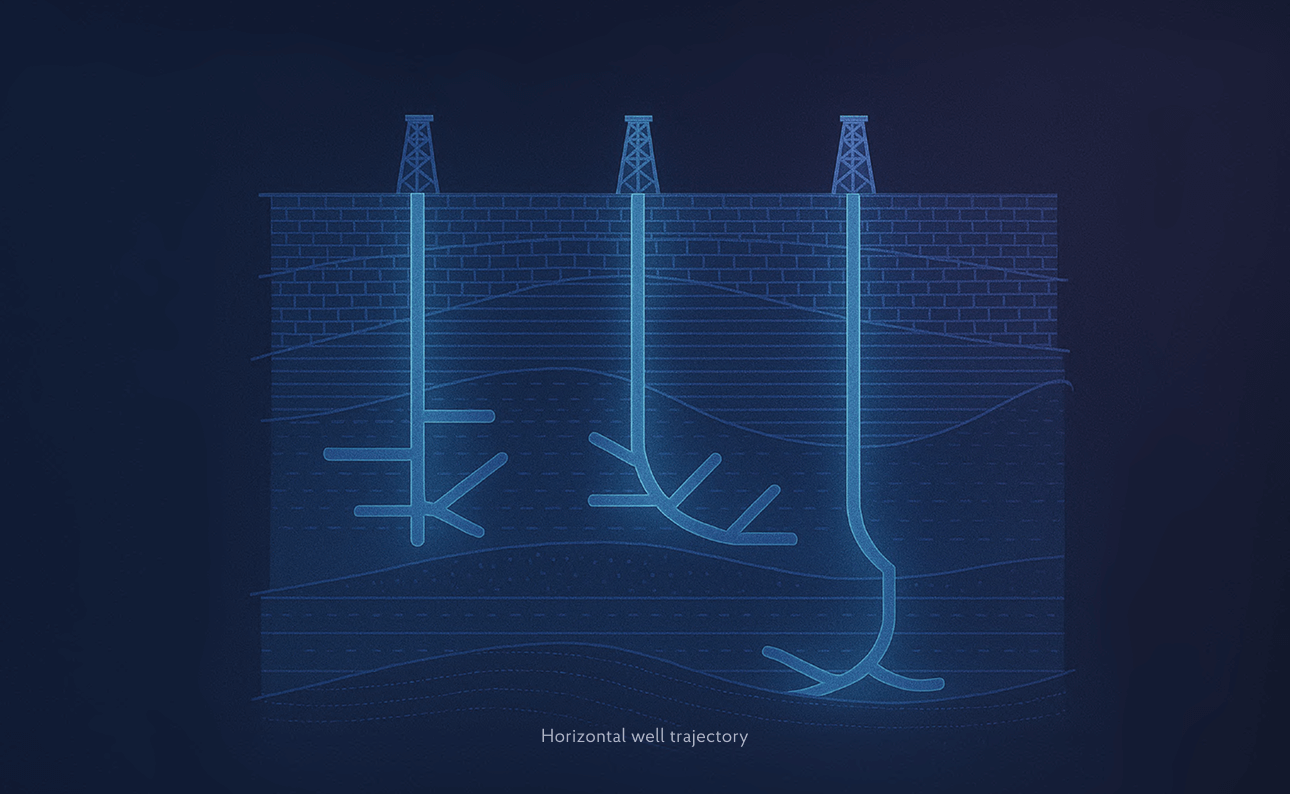

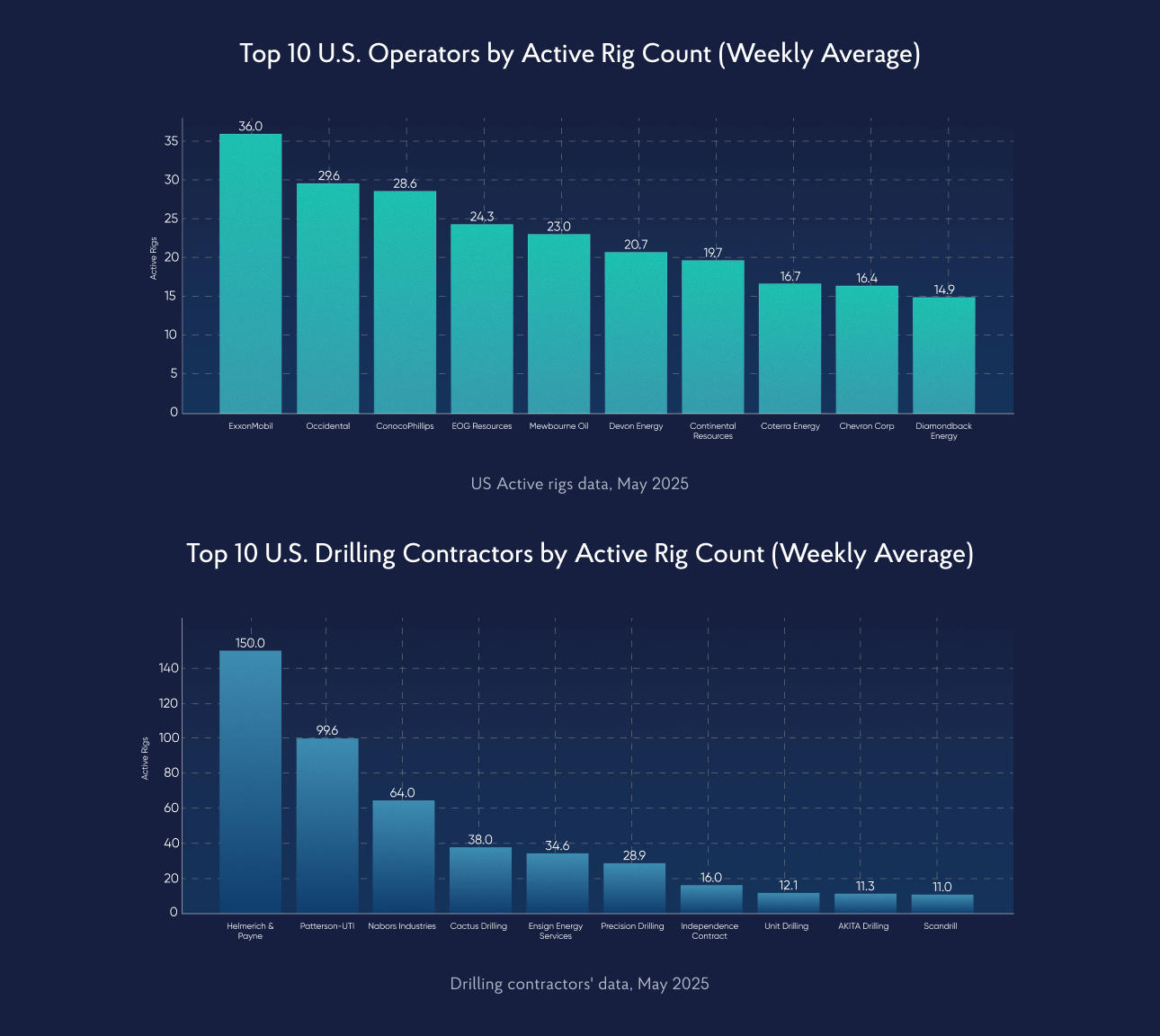

The United States is home to some of the world’s largest oil and gas fields, making it a leading energy producer. According to the Enverus platform as of May 2025, the US operates an average of 617 active rigs, with approximately 655 wells being drilled concurrently. Land-based oil and gas drilling dominates, with horizontal wells comprising over 80% of activity. The Permian Basin alone accounts for 290 rigs, making it the most active field in play.

Oil well trajectories vary, although the most common well trajectory is a horizontal well that allows for maximum reservoir contact (Image 1). The average length of a horizontal well is 10,000 feet, and the average drilling time is approximately 14 days, with an average cost of about $2.6 million.

Drilling processes are executed by a mix of public and private operators, supported by major contractors like Helmerich & Payne, and Patterson-UTI.

Weekly changes in rig count reflect shifts in operator strategy and budget focus:

In practice, this means the following:

- Any gain in drilling efficiency (even if it is 1-2%) translates to millions in cost savings. This is the prime target zone for AI. For example, in 2025 Occidental reported a 17% improvement in drilling duration per well and an 18% reduction in drilling costs compared to 2024. These gains have allowed the company to optimize its rig count while maintaining production targets.

- Leading drilling contractors may be incentivized to adopt AI, as this technology can enhance operational speed and safety, strengthening their competitive positioning in the market. Faster and more efficient drilling allows them to release and redirect rigs to new locations more quickly.

- AI can add real-time validation of rig status using telemetry, machine vision, or automated classification, improving rig utilization analytics, uptime, and Non-Productive Time (NPT) detection.

From reducing cycle times to enhancing rig allocation, AI technologies offer a clear path to operational and financial gains. This requires a structured approach.

The following section outlines a practical framework for pinpointing high-value opportunities across drilling operations, ensuring that AI investments are both targeted and transformative.

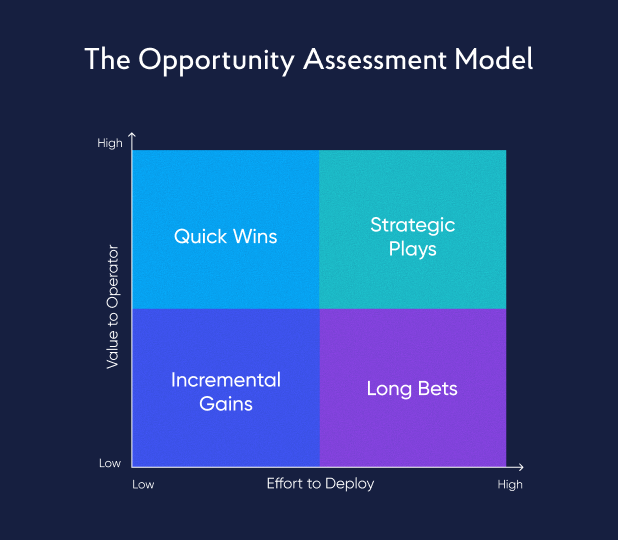

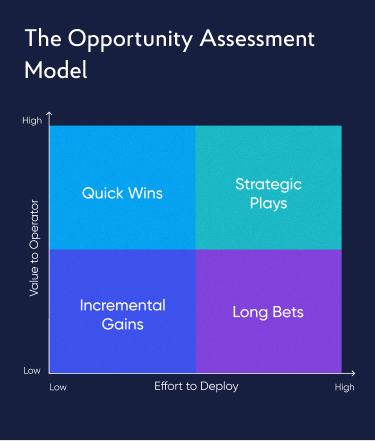

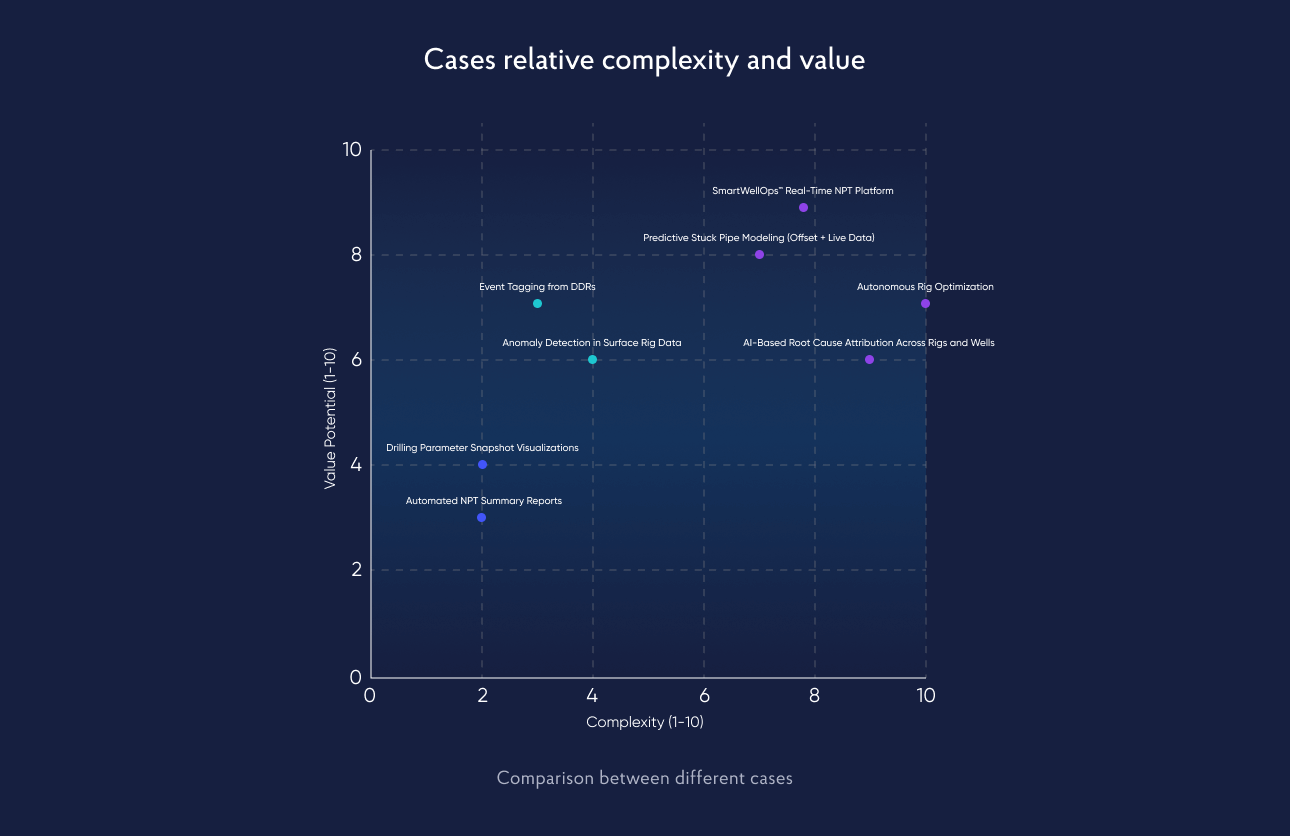

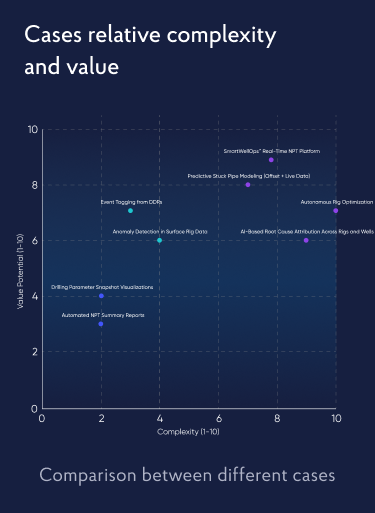

This entails a two-axis framework:

#1 Value to Operator.

High-value areas typically involve non-productive time, equipment failure, and safety-critical decisions. How much will the AI solution improve cost, time, safety, and decision quality?

#2 Effort to Deploy.

How difficult will it be to apply the solution in the field? Considerations include data access, system integration, validation time, and organizational alignment.

These axes create four areas of opportunity:

Quick Wins.

High-value, low-effort (e.g., NLP-based event extraction from daily drilling reports)

Strategic Plays.

High-value, high-effort (e.g., predictive stuck pipe modeling using real-time rig data)

Incremental Gains.

Low-value, low-effort (e.g., automating certain reporting tasks to streamline workflows)

Long Bets.

Low-value, high-effort (e.g., full AI-based rig automation)

This matrix helps AI teams direct resources to use cases that are both meaningful to operators and feasible within the constraints of a typical pilot or first deployment. In the following sections, we examine specific NPT-related solutions and assess how they map to this framework in terms of business value and implementation.

Drilling operations are a primary source of cost and risk in upstream oil and gas; at the same time, the process generates a lot of data. This data includes information about when, how, for how long, and why the well drilling process has been interrupted. Non-Productive Time remains one of the most persistent and financially significant inefficiencies, often accounting for 15-25% of total rig time.

This section breaks down specific AI implementation scenarios for reducing NPT and addressing operational pain points. Each example is analyzed through the lens of the opportunity assessment model introduced earlier, with attention to both technical feasibility and business relevance.

The chapter includes solutions referenced in SPE papers and industry deployments, offering a structured view of how these different approaches compare within the complexity-value matrix.

Quick Wins

Some NPT reduction opportunities can be addressed without real-time system integration or long pilot cycles. These use cases rely on existing data (such as daily drilling reports – DDRs) and offer a fast path to insight and impact using natural language processing (NLP) and anomaly detection.

1

Daily drilling reports are rich in operational context but are typically written in unstructured language using technical shorthand and inconsistent terminology. LLMs trained or prompted on domain-specific language can now extract NPT-related events with high accuracy.

Example

KCA Deutag implemented a system that classified over 3 million DDR entries into standardized categories such as “waiting on cement,” “equipment failure,” and “rig-related downtime.” The initiative covered 91% of their rig fleet across land and offshore operations. Results were integrated into a performance dashboard, revealing untracked inefficiencies and enabling early interventions in drilling plans.

Deployment Advantage:

- Uses historical text data, no need for real-time feeds

- Proven over 90% classification accuracy

- Helps uncover “invisible lost time” not captured by structured fields

- Supports pattern recognition and process optimization across multiple wells

The main risks include inconsistent data quality in daily reports, which can affect model accuracy, and user skepticism toward auto-generated classifications. If the model lacks transparency or adaptability to local reporting styles, adoption may stall. There’s also a need for clear labeling standards, especially when events span multiple categories or multiple crews/providers.

2

Drilling dysfunctions often present as subtle deviations in sensor trends, such as unexpected changes in hookload, torque or standpipe pressure. Lightweight anomaly detection models can flag these patterns before they escalate into NPT incidents.

Example

SPE case study (e.g., SPE-220725-PA) demonstrates the successful application of unsupervised models to time-series data for early detection of pressure anomalies associated with stuck pipe and mud losses. These systems were integrated with an existing network of sensors (EDR feed) and used to support real-time monitoring dashboards.

Deployment Advantage:

- Requires minimal engineering effort, using already-captured data

- No major IT integration; outputs can feed directly into Excel or existing visualization tools

- Enables proactive responses to developing dysfunctions

- Accelerates learning from offset well behavior

Key roadblocks include the risk of false positives leading to alert fatigue, limited contextual inputs that constrain interpretation, and challenges in integrating alerts into operational workflows. Without real-time access to EDR data or alignment with decision-making processes, these models may be underutilized despite their technical validity.

Strategic Plays

These opportunities target core drivers of NPT and offer significant operational and financial benefits. However, they require complex integration, domain alignment, and strong field validation. Success depends on both technical capability and organizational readiness.

1

Example

This mirrors field-tested designs by SLB and other companies, where LLMs and machine learning were used to classify drilling risks from live data streams and DDRs. In one deployment, SLB’s LLM system identified about 85% more actionable events than conventional reporting across 24 wells, many of which were previously marked “normal.”

Deployment Advantage:

- Combines real-time and historical data sources

- Provides immediate decision support at the rig site

- Aligns with operator priorities: cost control, safety, operational visibility

- Scalable across drilling campaigns and rig fleets

Integration with live rig systems (e.g., Pason, NOV) and real-time data streams is technically complex and requires collaboration with IT and HSE. Field validation for predictive alerts demands time and trust from operations teams. Explainability of ML outputs is critical – if field engineers do not understand model behavior, they will disregard it.

2

Stuck pipe events are among the most costly NPT incidents. Resolving a stuck pipe requires specialized techniques, and it can be a lengthy process, further extending NPT.

The solution is to use supervised ML models trained on offset well data, drilling parameters, and BHA configurations to predict stuck pipe likelihood in real-time, allowing for preventive measures such as altering drilling practices or downhole tool configuration.

Example

As documented in SPE-220725-PA, predictive models were developed using time-series patterns of torque and drag, along with depth and lithology. Results showed early warning signals for high-risk intervals and informed mitigation actions that reduced stuck pipe rates.

Deployment Advantage:

- Targets high-cost, high-impact NPT category

- Uses existing rig data + pre-drill metadata

- Enables proactive decision-making before escalation

- Validated in multiple basins and operational contexts

Accurate prediction depends on the quality and consistency of historical event tagging as well as real-time data. Differences in formation behavior, BHA design, and operator practices limit model use for different assets. Trust is critical; false positives or unclear logic can reduce credibility and limit use in live operations.

Incremental Gains

These use cases offer fast deployment with little complexity, but limited operational impact. They are best suited for internal tooling or as low-risk entry points to demonstrate capability.

Automated NPT Summary Reports

Tools that extract structured downtime data and generate standardized reports are already used by several operators. They reduce manual effort and improve reporting consistency, but do not directly reduce NPT. Adoption may be limited if engineers already use custom tools, and the perceived value can be low unless integrated into broader performance workflows.

Drilling Parameter Snapshots and Visual Tools

Auto-generated plots of ROP, torque, and pressure trends support technical reviews and planning. These tools are simple to implement and useful for rapid lookbacks. However, they lack prescriptive value, and without clear interpretation, may be overlooked in favor of manual analysis or existing dashboards.

Long Bets

These solutions can fundamentally transform drilling operations but face major technical, organizational, and market readiness challenges. While potentially valuable in the long term, they are rarely viable as initial entry points for AI vendors.

1

This concept involves building AI agents, often using reinforcement learning (RL) or digital twins that continuously adjust drilling parameters to optimize performance without human intervention. The system learns from simulated environments or historical data and proposes or applies control decisions in real time.

Example

In SPE-223828-MS, the authors explored a hybrid RL agent trained on synthetic data and physics-based simulators to optimize weight on bit and rotary speed. While promising in theory, the system remains in the testing phase and is not yet field-validated.

Deployment Advantage:

- Long-term potential to eliminate routine human inputs

- Could enhance consistency and precision across drilling campaigns

- May serve as the foundation for future autonomous well construction

The gap between simulation and field reality is significant, and most operators are not prepared to hand over control to AI systems, especially in safety-critical operations. Regulatory concerns, interpretability, and lack of operational trust are major barriers. The important question is, who will be held responsible for a failure, or praised for success? Additionally, creating a reliable digital twin for varied geology and rig configurations is resource-intensive and slow to scale.

2

This solution uses unsupervised learning or clustering techniques to analyze large volumes of NPT events across wells, rigs, and operators, seeking to automatically group incidents by root cause, region, or rig type. It aims to support long-term planning, but not real-time operations.

Some companies have used internal tools in attempts to cluster NPT causes from historical DDRs and sensor logs, to support drilling campaign planning and benchmarking. These tools are typically limited to internal use due to interpretability and quality issues in raw data.

Deployment Advantage:

- Useful for cross-well learning and portfolio-wide efficiency reviews

- Can uncover systemic causes of downtime not visible in single-well analysis

- Enhances knowledge transfer across teams and regions

Root cause attribution is inherently noisy due to inconsistent labeling and missing context. Clustering outputs often lack clear interpretability, which reduces actionability. Engineering teams may not trust algorithmic groupings unless supported by transparent logic or domain input. Deployment also requires broad access to clean, standardized multi-well data, which is rarely available.

When an AI initiative for drilling optimization moves from planning to execution, one of the most critical early decisions is the selection of a foundation model.

Choosing the right foundation model requires balancing model scale, domain alignment, and operational feasibility, while ensuring data privacy, security, and compliance throughout the workflow.

When selecting a foundation model, AI teams should begin with a clearly defined use case tied to operational goals. The typical sequence advises:

Larger models (e.g., Llama) offer superior reasoning but are more expensive and resource-intensive. Mid-sized models may offer an optimal balance for DDR-level analysis if prompt engineering is done well. A recent SPE study (e.g., SPE-222023-MS Retrieving Operation Insights with GenAI LLM ) showed that domain-tuned LLMs significantly outperformed both traditional ML and early GPT models in identifying and classifying NPT causes from historical DDRs.

Ultimately, model selection should be guided by the problem, not the model. In the case of drilling, success depends on choosing a foundation model that can be tuned to field-specific data, produce explainable outputs, and operate efficiently within the safety-critical, time-sensitive constraints of the industry.

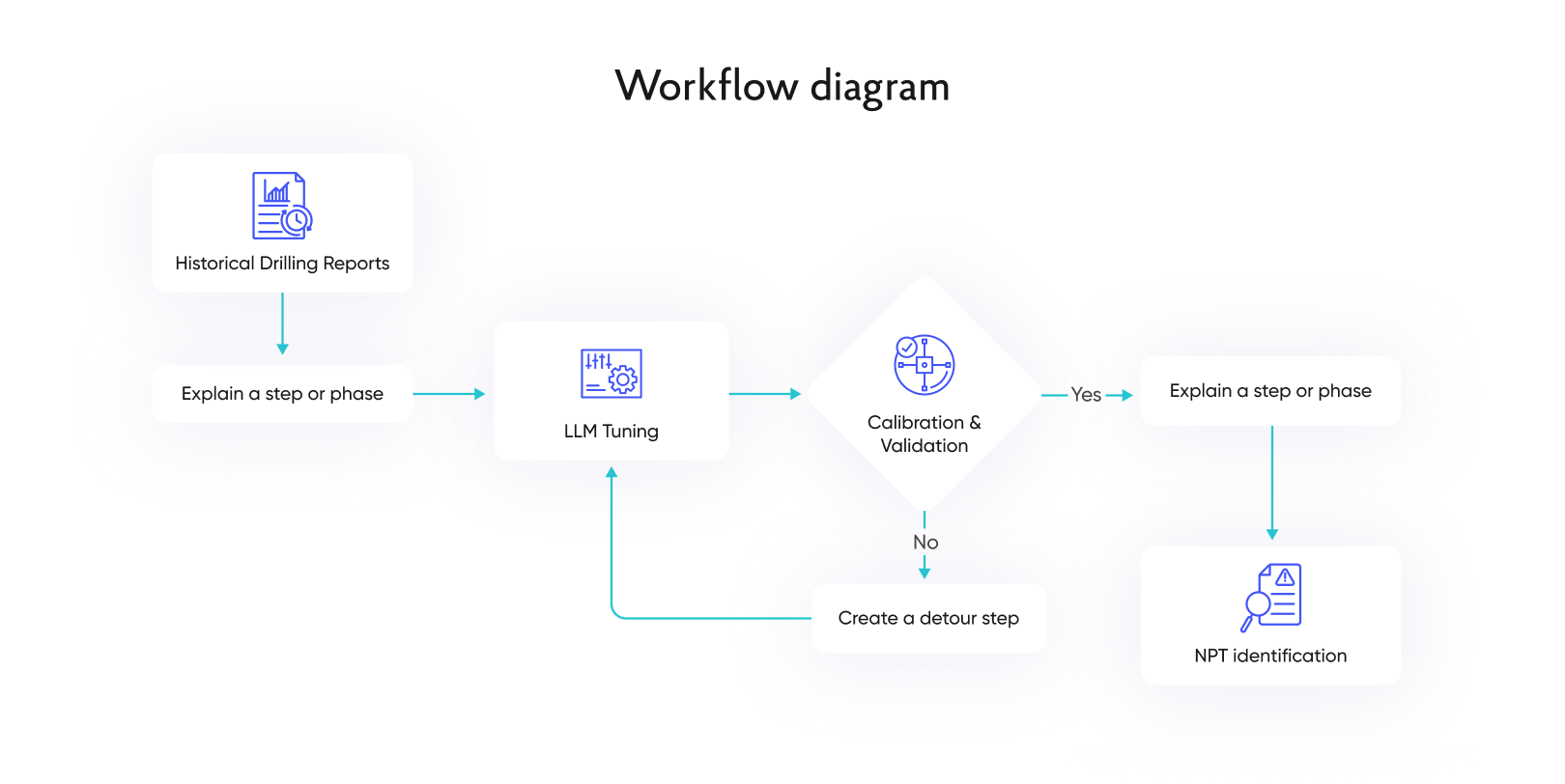

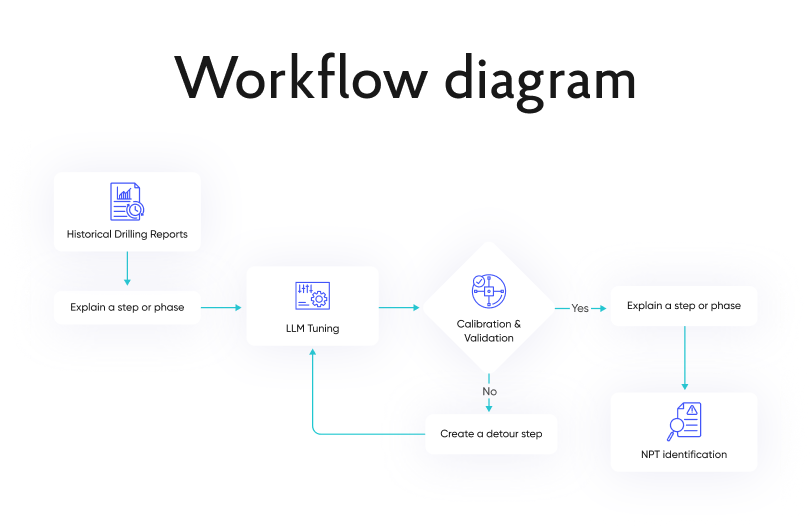

An upstream operator with active drilling across major US shale basins had a large volume of historical Daily Drilling Reports, but lacked an efficient way to extract structured insights from unstructured data. The opportunity lied in reducing Non-Productive Time and improving drilling performance, all without disrupting current reporting practices.

Provectus developed a GenAI-powered solution that leveraged a domain-tuned LLM to classify and extract NPT events from DDRs across 13 predefined risk categories. The solution was deployed within a cloud-native, OSDU-aligned data architecture and integrated with existing SCADA and metadata systems. Throughout implementation, outputs were validated by drilling engineers to ensure operational accuracy and eliminate noise.

As a result, the client received an advanced GenAI solution that can accurately process over 1,500 DDRs in under two hours, achieving over 94% alignment with expert classifications and surfacing up to 7% of previously unreported NPT events. These insights contributed to a 5% reduction in drilling costs and enabled a net reduction of two rigs. The system now serves as a foundation for campaign-level benchmarking and proactive risk mitigation.

Provectus offers a clear and proven path forward toward GenAI adoption with a structured program available through AWS Marketplace. Our subject matter experts and technical team will guide your organization through every step, to help you quickly adopt and implement the most impactful GenAI use cases.

.png)