AI Underwriter for Risk Management In

Financial Services

Accelerate your underwriting team’s decision-making with the GenAI solution by Provectus.

- Automate the processing of underwriting files to minimize risks in policy issuance

- Streamline the underwriting process to decrease bid times and increase proposal win rates

- Enable underwriters to use resources more efficiently, cutting operational costs

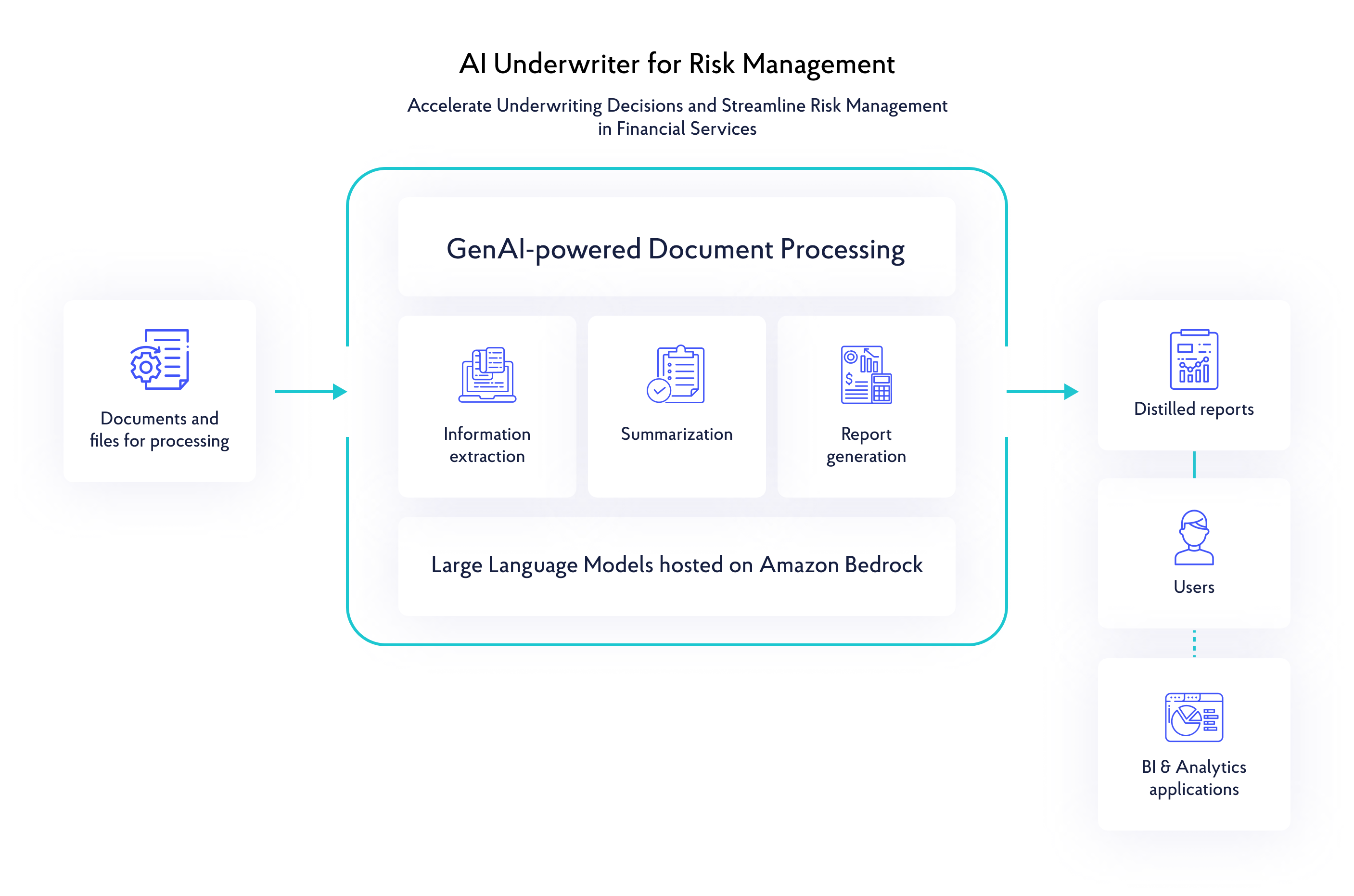

AI Underwriter is a GenAI-powered solution that streamlines the underwriting process for organizations in banking, financial services, and insurance sectors. Built on AWS, the solution leverages advanced large language models (LLMs) to extract and summarize decision-critical information from unstructured underwriting documents in PDF format.

The GenAI solution serves as a smart information retrieval and management system that extracts and summarizes decision-critical information from complex PDF forms, statements, and reports. It generates comprehensive summaries that enable underwriters to quickly assess risks, accelerating decision-making on policy issuance.

AI Underwriter is a powerful GenAI assistant for any underwriter who is looking to minimize routine manual tasks and reduce the time needed to prepare the final policy packet.

Types of documents that can be processed by the solution:

- Application forms

- Risk assessment reports

- Credit reports

- Policy quotation

- Proposal forms

- Terms and conditions

- Disclosures and notices

- Financial statements

- Anti-money laundering (AML) documentation

unstructured document

for underwriters

to GenAI & automation

CONTACT US!

Explore ways Provectus can help your organization transform insurance underwriting with generative AI

See the Provectus privacy policy for details on how we collect, use, and share information about you.

See the Provectus privacy policy for details on how we collect, use, and share information about you.